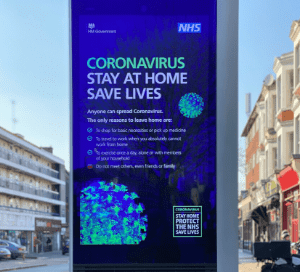

Lockdown tensions: Settling ongoing neighbour disputes during the pandemic

Lockdown tensions: Settling ongoing neighbour disputes during the pandemic With many of us spending substantially more time at home, what were seemingly minor problems with neighbours might start becoming more of an issue than they were before. Neighbour disputes can arise from behaviour that we have previously ignored or not had time to address